Contact

-

Herengracht 33

1398 AB Muiden (NL) - vermogensbeheer@faircapitalpartners.nl

- impactinvesting@faircapitalpartners.nl

Water lily painting: Licio Passon www.liciopasson.it

Phone

About us

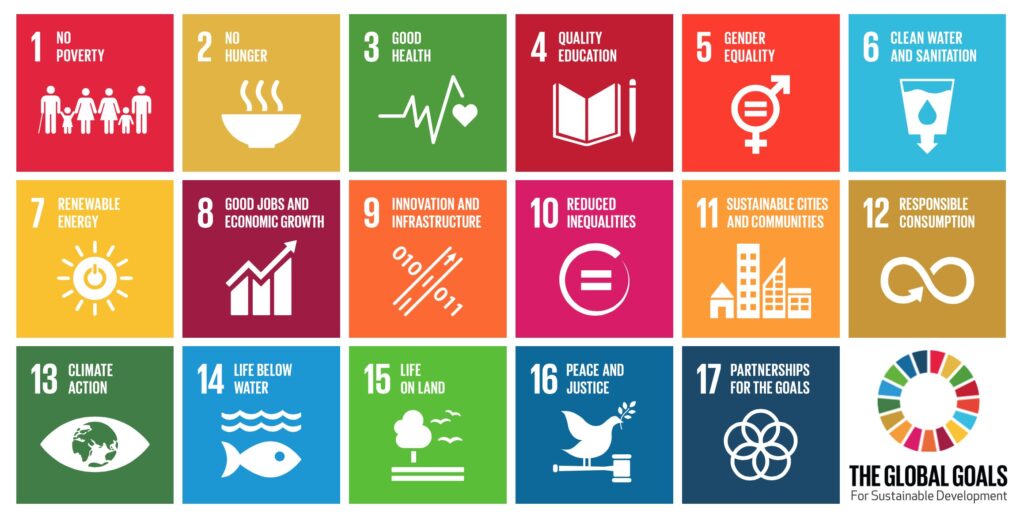

- Sustainable and personal

- In accordance with ASN Bank’s sustainability policy

- For assets in excess of € 250,000

- Let experts take care of your assets

- We help you achieve your investment goals